Seyfarth Synopsis: As the number of class actions alleging FCRA violations continues to skyrocket, it is critical for California employers to understand the basics of all laws affecting employment screening programs. This blog examines those laws and provides practical considerations for employers looking to hire or rehire employees during a shutdown affecting critical sources of information needed for background

Continue Reading The Business of Background Checks During a Pandemic

Ban the Box

California Employers Watch Out! Legal Minefields for Background Checks

Seyfarth Synopsis: California’s ban-the-box law strictly regulates how employers may obtain and consider background check information when hiring and making personnel decisions. What’s more, Los Angeles and San Francisco have their own ban-the-box ordinances. These ordinances and the California Labor Code create a patchwork of rules that put employers at risk when checking whether an applicant has a criminal record. …

Continue Reading California Employers Watch Out! Legal Minefields for Background Checks

Five Interview Question Don’ts for California Employers in 2019

Seyfarth Synopsis: Recent California legislation, including laws banning questions about salary history and criminal convictions, has bought new interview jitters for employers. These new laws, along with the Fair Employment and Housing Act’s prohibitions against questions going to an applicant’s protected status, confirms the point that there is such a thing as a “bad interview question.” In this ever-changing …

Continue Reading Five Interview Question Don’ts for California Employers in 2019

California Employers: Beware the Background Check Bugaboos

Seyfarth Synopsis: California is rife with regulation of how employers may obtain and consider background check information for use in hiring and personnel decisions. The relatively new California ban-the-box law (effective January 1, 2018) and the older Los Angeles and San Francisco ordinances and amendments to the California Labor Code set strict rules on when and how employers can consider …

Continue Reading California Employers: Beware the Background Check Bugaboos

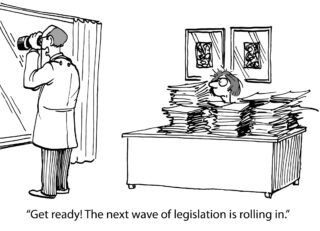

2017 Labor & Employment Legislative Update: It’s Finally Over! (For Now…)

Seyfarth Synopsis: New statutory obligations for California employers in 2018 will include prohibitions on inquiries into applicants’ salary and conviction histories, expanding CFRA to employees of smaller employers, expansion of mandatory harassment training to include content on gender identity, gender expression, and sexual orientation, and new immigration-related restrictions and obligations.

California Governor Jerry Brown spent his last day to sign…

California Governor Jerry Brown spent his last day to sign…

Continue Reading 2017 Labor & Employment Legislative Update: It’s Finally Over! (For Now…)

California Passes State-Wide Ban-the-Box Law

Seyfarth Synopsis: The California Legislature has just created yet another protected class of individuals entitled to sue employers under the Fair Employment and Housing Act. The new class of potential plaintiffs are applicants denied employment because of their conviction history, where the employer is unable to justify relying on that conviction history to deny employment.

We’ve reported on two January…

We’ve reported on two January…

Continue Reading California Passes State-Wide Ban-the-Box Law

San Francisco-Peculiarities: The City’s Ultra-Unique Employment Landscape

Seyfarth Synopsis: As if high rent and California’s peculiar laws were not enough to worry about, San Francisco employers must also comply with City-specific ordinances. Trailblazing City requirements often exceed state laws and have sometimes been harbingers of state-level enactments. One might say that San Francisco, with its distinctive laws, is to California what California is to the rest of …

Continue Reading San Francisco-Peculiarities: The City’s Ultra-Unique Employment Landscape

2017 Labor & Employment Legislative Update: House of Origin Deadline

Seyfarth Synopsis: Pay equity and Ban The Box bills lead the list of bills approved to continue their quest (moving to the other house of the California Legislature) to become California law.

Friday, June 2, marked the last day for bills in the California Legislature to pass out of their house of origin—the Senate or Assembly—and continue the legislative process…

Friday, June 2, marked the last day for bills in the California Legislature to pass out of their house of origin—the Senate or Assembly—and continue the legislative process…

Continue Reading 2017 Labor & Employment Legislative Update: House of Origin Deadline

2017 California Labor and Employment Legislative Update: What to Watch

Seyfarth Synopsis: Back from Spring Break, and Back to Work: Our List of L&E Bills to Watch in the remainder of the 2017-2018 California Legislative Session.

California Legislators were, as always, very busy in the first few months of the 2017-18 Legislative Session, introducing well over 2000 bills by the February 17th bill introduction deadline. But, in comparison to prior…

California Legislators were, as always, very busy in the first few months of the 2017-18 Legislative Session, introducing well over 2000 bills by the February 17th bill introduction deadline. But, in comparison to prior…

Continue Reading 2017 California Labor and Employment Legislative Update: What to Watch

New Regulations Limit California Employers’ Consideration of Criminal History

Seyfarth Synopsis: The California Fair Employment and Housing Council (“FEHC”) has approved new regulations, effective July 1, 2017, to limit employers’ use of criminal history when making employment decisions.

New Regulation Highlights

New Regulation Highlights

Updating our prior post, the FEHC has finalized new regulations on employer consideration of criminal history, largely adopting the guidance set forth by the Equal Employment Opportunity…

Continue Reading New Regulations Limit California Employers’ Consideration of Criminal History